Silver presents a tangible way to hold value that many find both practical and satisfying. Newcomers often want straightforward options that do not demand a deep knowledge of markets or rare coin lore.

The following selections balance ease of purchase, liquidity, and cost efficiency while keeping choice simple for a first step. Each option carries traits that make it friendly to a beginner looking to build exposure to silver.

1. American Silver Eagle Coins

The American Silver Eagle is a widely recognized government minted coin that contains one troy ounce of pure silver and carries legal tender status in the United States.

Its broad name recognition tends to produce tight bid ask spreads which help reduce costs when buying or selling with reputable dealers.

Many buyers appreciate the mix of aesthetic appeal and clear silver content which makes these coins easy to show or store depending on personal preference. Collectors and investors alike trade these coins frequently which gives a new buyer confidence in liquidity.

When choosing among versions look at condition and certification as both can affect value beyond the metal content so take a measured approach to grading and seller reputation.

Many dealers offer both bullion versions meant for stacking and proof versions struck for collectors with higher premiums on mint state examples.

For storage a modest safe or bank safe deposit box will keep pieces secure while numbered certification sleeves add a layer of trust for resale. A rule of thumb for a beginner is to buy from established dealers with clear buy back policies.

2. Silver Rounds

Silver rounds are privately minted one ounce pieces that offer the same silver content as government coins but often at a lower premium above spot price. These pieces come in a wide range of designs which can make assembling a small stack more enjoyable and less formal than government issued coins.

For beginners seeking a reliable source, many turn to Money Metals silver rounds, which are known for consistent quality and trusted mints.

Since rounds are produced by many mints price competition tends to keep markup modest which helps a buyer stretch funds further when purchasing small increments. For a starter stack rounds provide a straightforward way to accumulate metal without a large up front cost per piece.

Quality varies so check that a mint has a solid reputation and that products are free of plating or base metal cores which can be an issue with very cheap offerings. Visual inspection and a basic weight and dimension check serve most beginners well when buying in person and basic electronic testers help in remote purchases.

Because concealment and portability matter to some owners rounds fit neatly into tubes for compact storage and quick audits. When the time comes to sell many dealers accept rounds from known private mints without a fuss.

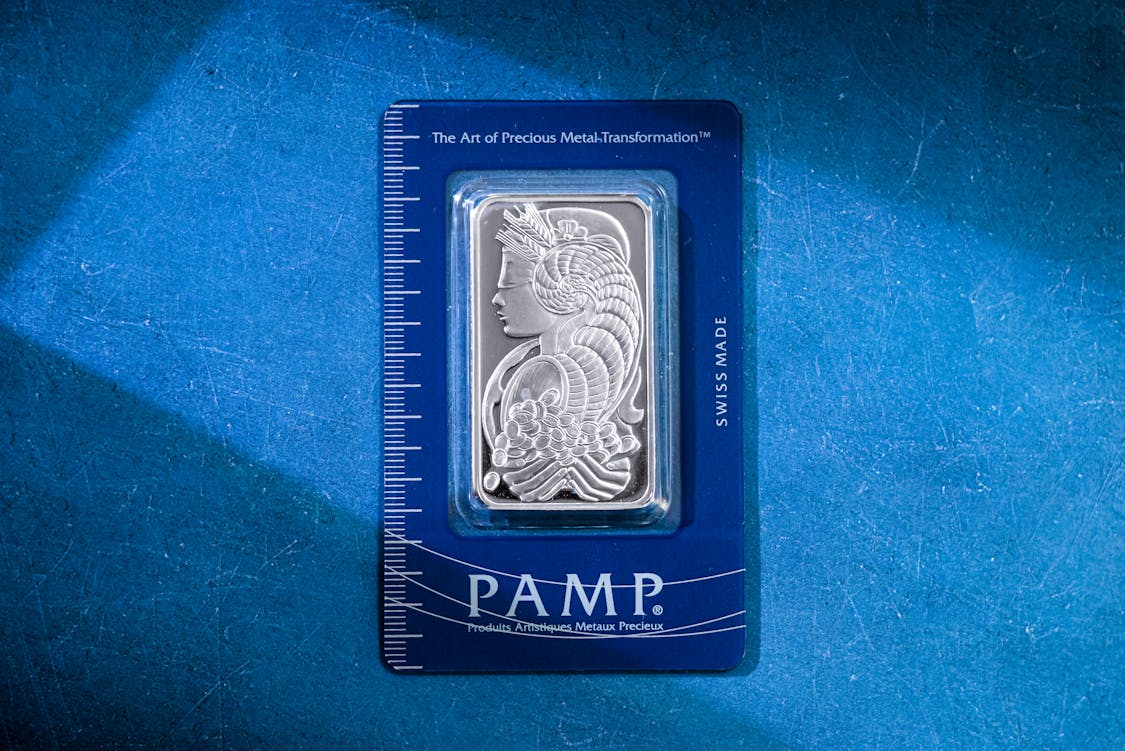

3. Silver Bars From Reputable Refineries

Silver bars provide lower premiums per ounce than coins when bought in larger sizes which makes them attractive for stacking greater metal amounts with fewer pieces to manage.

Refineries with a long history and visible branding typically back their bars with certificates or serial numbers that make tracking and authentication simpler.

Bars arrive in many sizes so a starter buyer can choose a balance between cost per ounce and ease of handling to suit personal needs and storage plans. Because bars are concentrated they reduce packaging waste and make bulk storage more efficient in a small home safe.

Choose refineries that publish assay information because that adds a layer of trust when you decide to liquidate and may speed sale to a dealer or private buyer. Many retailers will highlight refinery names and assay numbers up front which helps an inexperienced buyer avoid low quality producers.

For buyers who want to trade without taking delivery there are avenues to buy allocated inventory that still keeps a link to physical metal while minimizing immediate handling. A careful first purchase of a bar from a known house can feel like putting a firm cornerstone under a budding stack.

4. Junk Silver Coins

Junk silver refers to circulated coins minted before modern clad composition rules that contain a high percentage of silver in everyday pocket change form and these often sell by weight.

For many beginners the appeal lies in the relatively low premium for silver content coupled with the ready availability of mixed lots of dimes quarters and halves.

Because these coins are common their market is well established and dealers buy and sell junk silver with predictability which makes it a practical entry point.

Holding pieces that carry a small face value while representing intrinsic metal is a neat way to link history to a basic bullion strategy.

When buying check the actual silver content which differs by year and coin type and be clear on the seller terms for weight versus face value transactions to avoid surprises.

These coins do not typically come in protective packaging so a simple tube or flip helps protect against further wear and reduces tarnish contact with other metals.

Many people like the tactile element of handling coins that once circulated widely and find it an engaging introduction to metal ownership. For a first time buyer a small lot of junk silver can be a friendly manner to cut teeth without facing high premiums per ounce.

5. Silver Exchange Traded Funds

Silver Exchange Traded Funds provide exposure to the price of silver through brokerage accounts without the need to physically store bars or coins which appeals to those who prefer market convenience.

Some funds hold physical silver in secure vaults while others track futures contracts so check fund structure to align holdings with personal comfort about physical backing.

Buying shares is as simple as any stock trade and that opens silver to a broad spectrum of investors who want liquidity and easy entry and exit through standard trading platforms.

Fees for funds are visible and recurring which makes cost assessment straightforward when planning a long term approach.

A paper based path removes the logistics of secure storage and insurance and that can suit people who are short on space or who prefer financial custody over personal safekeeping.

Keep in mind that a share in a fund does not grant possession of a bar or coin and redemption policies vary by issuer which affects how a shareholder might convert holdings into physical metal.

For a beginner this option places silver within familiar investing routines and can be paired with occasional physical purchases to create a mixed approach. Treat fund selection like any other financial choice and note expense ratios and fund structure up front.